Floor Plan Lending Risks

Describes the risks associated with floor plan lending sound risk management practices and regulatory risk rating guidelines.

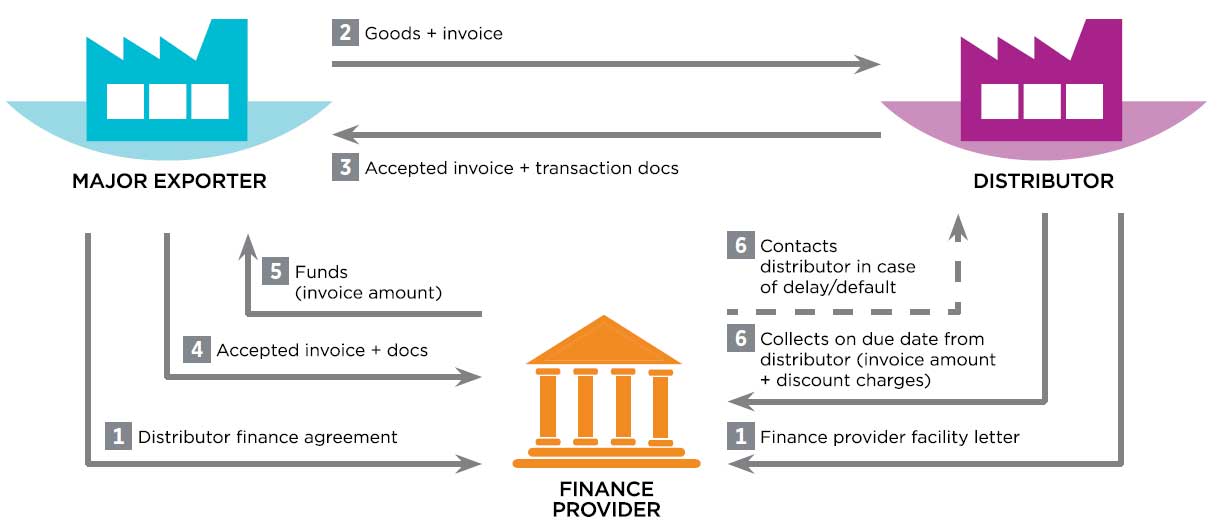

Floor plan lending risks. Floor plan financing is a revolving line of credit that allows the borrower to obtain financing for retail goods. This booklet applies to the occ s supervision of national banks and federal savings associations. Items commonly financed through a floor plan facility are automobiles. Floor planning is a form of financing for large ticket items displayed on showroom floors.

For example automobile dealerships utilize floor plan financing to run their businesses. Floor plan lending services efficiently maximize your working capital. For example a dealer might be able to borrow 10 million over the year to purchase 300. This booklet addresses the risks associated with floor plan lending and discusses risk management practices for floor plan lending.

What does peoples offer as a floor plan lender. How does floor plan financing work specifically to benefit auto dealers. Floor plan finance companies are uniquely attuned to the needs of auto dealers. Dealer floor plan financing frequently asked questions for borrowers and lenders what is floor plan financing.

The loans are often made with a one year term and based on an aggregate budget. Using cash or a bank line of credit to purchase inventory can work for some car dealers but many floor plan financing companies offer a variety of dealer specific benefits. Floor plan lenders include local and regional banks large national banks and financing companies owned by the manufacturing companies like toyota financial or ford credit. For dealerships that follow the rules floor planning can prove to be an excellent business agreement between the lender manufacturer and dealer.

Provides an expanded examination procedures section and appendixes that include a glossary examples of risk rating cases and indicators for quantity of credit risk and quality of credit risk management. An auto rv manufactured home etc. Floor plan financing is also done for large appliances mobile homes and boats among other items and these products are usually sold to consumers with a financing contract. And are subject to risks including the possible loss of principal.

Impact of floor plan lending activities on a bank s risk profile and financial condition. These loans are made against a specific piece of collateral i e. The dealer then receives payment hopefully including a profit and remits the balance to the lender who in turn releases the title to the car to the new purchaser. For dealer floor plan lenders however there can be quite a bit of risk involved as they don t have full control over the loan collateral the vehicles.

:max_bytes(150000):strip_icc()/GettyImages-99276138-164b389a35084e02b4b9a0305925365f.jpg)